How To Setup A Singapore Subsidiary Company |

您所在的位置:网站首页 › subsidiary company › How To Setup A Singapore Subsidiary Company |

How To Setup A Singapore Subsidiary Company

|

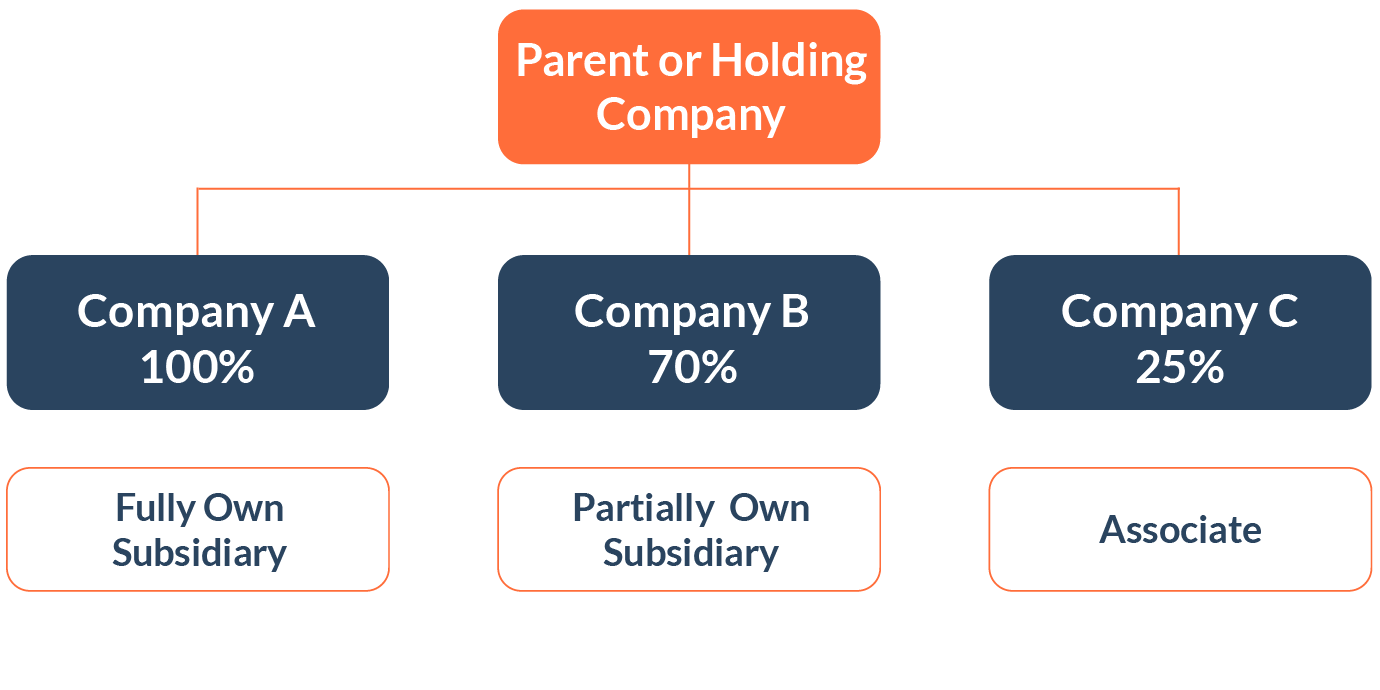

When a foreign company wants to start a business overseas, the first thing comes to their mind is forming a subsidiary. Let dive in and understand what is and how to register a Singapore subsidiary. What is a Singapore Subsidiary Company?A Singapore subsidiary company is a private limited company where the majority shareholder is a corporate entity own by their parent or holding company normally located from overseas jurisdiction. After the subsidiary is formed, there is a relationship between a parent company (simply, a parent) and its subsidiary (or subsidiaries) in which the parent controls its subsidiary. This is in terms of the ability to influence and direct the financial and operating policies of the subsidiary to the benefit and best interest of the parent. Shares Ownership of a SubsidiaryTo be considered a subsidiary, there must be a minimum 50% of share ownership by their foreign parent or holding company. It also means that the minimum parent share ownership is between 50% to 99% only. The remaining 1% to 50% of the shares can be held by either an individual or corporate legal entity such as a partnership, sole proprietorship, or any other legal entity. If the parent has 100% share ownership of their subsidiary, it is considered a wholly-owned subsidiary. The differences lie in the percentage of shares ownership, and this will affect the accounting, legal influence, licensing of the subsidiary. For example, in Singapore, to qualify for most of Singapore government funded grants or incentives, there is a rule that 30% ownership must be a local company or an individual.  Why do foreign companies form a Subsidiary? Why do foreign companies form a Subsidiary?There are 2 reasons why setting up a subsidiary is the best route for foreign companies: 1) Separate from parent company The parent company wants venture into a new business in a different industry and perhaps even a different branding. Forming a subsidiary will result in an independent legal and financial entity that separates them from their parent company. For example: A property developer bought new land to develop a new condominium. They will always form a new subsidiary for their new development. This is a form of risk management as a subsidiary is responsible for its own legal liabilities as well as its debts and taxes. It also means that lawsuits against the subsidiary cannot collect against the parent company’s assets, only those of the subsidiary. 2) Too many different and large volumes of individual shareholders under parent company It is unpractical to form a new company using the parent company’s individuals as shareholders. In relationship to the above, the parent company may want to form or already have hundreds of subsidiaries. Henceforth, when there a change in parent shareholdings, it wouldn’t be practical to alter shares of so many subsidiaries |

【本文地址】

今日新闻 |

推荐新闻 |